Dynamic Funds® is a registered trademark of its owner, used under

license, and a division of 1832 Asset Management L.P.

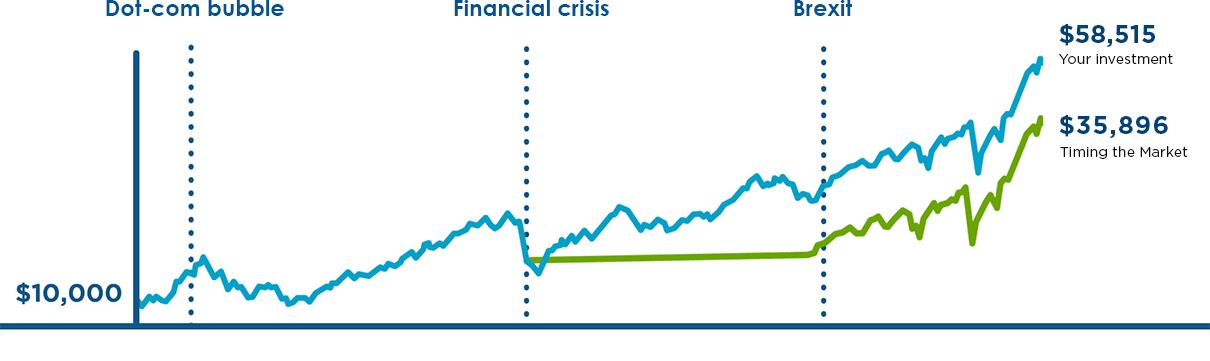

For illustrative purposes only. The illustration shows the hypothetical growth of $10,000 invested in

the Maximum Growth portfolio between December 31, 2002 and December 31, 2022. The Maximum Growth, Growth

and Balanced portfolios used in this illustration are hypothetical in nature and are represented by the

following (indices parenthesized): Maximum Growth portfolio (100% S&P/TSX Composite TR Index), Growth

portfolio (75% S&P/TSX Composite TR Index, 25% FTSE Canada Universe Bond Index), Balanced portfolio (50%

S&P/TSX Composite TR Index, 50% FTSE Canada Universe Bond Index). Cash uses a hypothetical 1.25% rate of

return. Assumes reinvestment of all income and no transaction costs or taxes. Indices are not managed and

it is not possible to invest directly in an index. The illustration is hypothetical and does not reflect

actual results or the future returns or future value of a mutual fund or any other investment. Comparison

scenario assumes "Stay Invested" was chosen at each decision point.

The information provided is not intended to be investment advice. Investors should consult their own professional advisor for specific investment advice tailored to their needs when planning to implement an investment and/or tax strategy to ensure that individual circumstances are considered properly and action is taken based on the latest available information.